Categories

- "leverage ChatGPT (1)

- # vaccination (1)

- #🇺🇸 USA (2)

- #Addiction (1)

- #AI (2)

- #AI #Scope (1)

- #AI #Scope #Technology #Internet #computer (13)

- #AI #Scope #Technology #mobile (2)

- #AI Scope (1)

- #ancient #mythology (1)

- #ancient #mythology #history #Mexico (1)

- #apple #Scope #Technology #Internet #computer #iPhone (2)

- #artificial intelligence #future # memory #AI (3)

- #Asia (1)

- #bestchild (1)

- #bowler #international (1)

- #Brazil (1)

- #California (1)

- #Career (2)

- #cars (1)

- #childcare (1)

- #childhood #diwali #Gharonda #festival #hindusm #india (1)

- #china (1)

- #Communalism (1)

- #Connectevity (1)

- #corona (1)

- #Cricket (1)

- #Currency (1)

- #Death (1)

- #Delhi (1)

- #Donald Trump V/s Biden (1)

- #Duniyadari #ChatGPT #artificial #intelligence #machine #learning #mira #altman #ceo (1)

- #Duniyadari #ChatGPT #artificial #intelligence #machine #learning #money #altman #ceo (2)

- #Duniyadari #ChatGPT #artificial #intelligence #machine #learning #money #online (1)

- #Earthquake. #world news (1)

- #education (4)

- #Egypt (1)

- #Election 2020 (1)

- #Election in US (1)

- #englishmedium (1)

- #Euro 🇺🇸 USA (1)

- #Evergiven (1)

- #Evolution (1)

- #eye (1)

- #Facebook (1)

- #finance #usa (1)

- #first bionic eye #invention #world #science #health (1)

- #Football (1)

- #freedom (1)

- #g20 (1)

- #Gandhi (1)

- #girforest (1)

- #gods (1)

- #google (3)

- #gpt #Enterprise (1)

- #gpt #gpt4 (1)

- #Gujarat (2)

- #Happiness (1)

- #HappinessIndex #Global #World #GDP (1)

- #history #blogs (1)

- #Images #viral (1)

- #India (3)

- #India #Bharat # Old English (1)

- #international (1)

- #Internet (1)

- #Inventions (1)

- #japan #deities (1)

- #Job (1)

- #jobupdate (1)

- #Jyotirlinga (1)

- #life #motivation #habits #care #writing #blogs (1)

- #Lion (1)

- #local #guide #Google #map #help (1)

- #Mark Zuckeberg (1)

- #Mathematics #IMO #Olympiad #World #Talent #HOTS #Questions (1)

- #Mathematics #World #Talent #HOTS #Questions (1)

- #Meta (1)

- #misson (1)

- #Moderneducation (1)

- #modernschool (1)

- #money (1)

- #Moon (2)

- #Natural (2)

- #Natural #trending (1)

- #Naturalbeauty (2)

- #nature (3)

- #nature #cyclones #Biparjoy #news (1)

- #newschool (1)

- #Newyear (1)

- #Newyear #2022 #Newhope (1)

- #NTPC (1)

- #oldestschool (1)

- #Online #Free #Education #Technology #Best online #Courses (2)

- #OpenAI (1)

- #OpenAI #ChatGPT #News #USA #Artificial (1)

- #Over use (1)

- #Pandemic (1)

- #Passport #Singapore #Japan #Country (1)

- #prelearning (1)

- #preschool (1)

- #President #OxfordStudentUnion (1)

- #Racism (1)

- #RasmhiSamant (1)

- #Result (1)

- #Rio-de-Janerio (1)

- #robot (1)

- #RRB (1)

- #school (2)

- #Science (1)

- #Ship (1)

- #SirEdwinLutyen #Protest (1)

- #Somnath (1)

- #Space #Science #technology #education (2)

- #student (1)

- #SuezCanal (1)

- #technology #developed #learning #education (4)

- #US (1)

- #Varaval (1)

- #virtual (1)

- #vision (1)

- #World (2)

- #World #money #usa #news (1)

- #world news (3)

- #YouTube (1)

- 🇸🇾 Syria (1)

- 19October (1)

- 2023 (1)

- 2024 (2)

- 25 December (1)

- About Meta FACET Facebook (1)

- accurate answers (1)

- accurately diagnose illnesses (1)

- acess Chinese chatbot free (1)

- ActingSchool (1)

- Adidas (1)

- Admisson (1)

- Affordable AI model (1)

- AI (48)

- AI accessibility (1)

- AI and media partnerships (1)

- AI blog (1)

- AI blogs (3)

- AI Careers (1)

- AI chat solution (1)

- AI Christmas (1)

- AI creative task (1)

- AI Detection (1)

- AI Detection tools (1)

- AI future (2)

- AI Images (3)

- AI in 2024 (1)

- AI in e-commerce (1)

- AI in education (2)

- AI in recruitment (1)

- AI in technology (1)

- AI in Trading (1)

- AI laws (1)

- AI model pricing (1)

- AI models (1)

- AI news (5)

- AI pdf (1)

- AI performance benchmarks (1)

- aI prediction about Earthquake (1)

- AI research (1)

- AI safety measures (1)

- AI Scope (1)

- AI technology (2)

- AI Tourism (1)

- AI travelling (1)

- AI Wings image with chair (1)

- AI-driven recruitment ROI-positive AI (1)

- AI-powered news distribution (1)

- AICars (1)

- aidriven chat (1)

- AIScope (1)

- AIsearchengines (1)

- Alaska (1)

- algorithms (1)

- altman (3)

- altman sam (4)

- America 🇺🇸 opportunity (1)

- Ancient #USD (1)

- Android (2)

- Anger (1)

- Angkor wat (1)

- Angkor Wat history (1)

- Angkor Wat Photo (1)

- Animal (1)

- Animals (1)

- Apple (1)

- Apple Intelligence (1)

- Apple watch (1)

- apps (3)

- apps for mobile (1)

- architecture (1)

- Artificial (10)

- artificial #intelligence (1)

- artificial Intelligence (40)

- Artificial Intelligence Company (1)

- artificial intelligence future (2)

- Artificial Intelligence In Health (1)

- Artificial Plants (1)

- ascent (1)

- Ask questions (1)

- athlete (1)

- atom dot (1)

- attitudes (1)

- Aurangzeb (1)

- Automotive (1)

- avatar (1)

- Award (1)

- awareness (1)

- Bard (3)

- best (3)

- best AI (1)

- best AI avatars (1)

- best AI chat support (1)

- best AI tools (3)

- best apps android (1)

- best apps mobile (1)

- Best Awards (1)

- best blogs (2)

- best business ideas (1)

- Best Chatbot (2)

- best chatbots (2)

- Best chatbots 2023 (1)

- best Chess (1)

- Best Christmas wish (1)

- best earning ways (1)

- Best jobs (1)

- Best PM (1)

- best profitable startup (1)

- Best Prompts (1)

- Best Promts (1)

- Best School in India (1)

- Best Stocks (1)

- Best Teachers Award (1)

- Best Tools for AI Images Detection (1)

- best wall painting (1)

- best way to earn money online (1)

- Bharat (1)

- Bill Gates (2)

- Bing (1)

- bitcoin (1)

- blog (5)

- blog case studies (1)

- blog post (1)

- blog writing (1)

- Blogger (1)

- blogging (4)

- blogs (17)

- Board OpenAI (2)

- Brand (3)

- British 🇺🇸 (1)

- business (1)

- Cambodia Temple (1)

- Candidate matching (1)

- Cardiac Problems (1)

- care (1)

- Career (2)

- Careers (2)

- Careers turning point (1)

- Cars (1)

- CBSE (2)

- cctv (1)

- celebrate (1)

- celebration (1)

- CEO (7)

- CEO Rakuten (1)

- Chat GPT (6)

- chatbot (10)

- chatbot 2024 (1)

- chatbot for business (1)

- Chatbot Uses (1)

- chatbot2023 (1)

- Chatbots (11)

- chatbots for education (1)

- Chatbots in Future (1)

- Chatgpt (60)

- ChatGPT #google #technical (2)

- ChatGPT AI (1)

- ChatGPT alternatives (1)

- ChatGPT content integration (1)

- ChatGPT Illya (1)

- ChatGPT in Trading (1)

- ChatGPT jobs (1)

- Chatgpt news (1)

- ChatGPT Office (1)

- ChatGPT openai (1)

- chatgpt prompts (2)

- chatgpt prompts business (1)

- ChatGPT5 (1)

- Chess (1)

- Chess champion (1)

- chesscom (1)

- ChessGPT (1)

- china (3)

- China India (1)

- Chinese (1)

- Choice (1)

- Christmas (1)

- Christmas Quotes (1)

- Class-10 Science (1)

- clean city (1)

- Climate (1)

- Club (1)

- coding (1)

- coin launch cosmos (1)

- commonwealth chess (1)

- communication (1)

- computer (3)

- Condé Nast collaboration (1)

- Condé Nast publications (1)

- Consensus (1)

- contact testimonials team (1)

- conversational AI (1)

- copilot (1)

- Cost-efficient AI (1)

- countries (1)

- COVID-19 (1)

- COVID19 (1)

- create images (1)

- creativity (2)

- Cryptcurrency (1)

- Cryptography (1)

- CSS (1)

- Culture (2)

- custom AI (1)

- DALL-E (2)

- dalle (2)

- Dalle AI (4)

- dalleai (1)

- Dance (1)

- Data Analysis (1)

- data science (1)

- Day trading (1)

- Deal (1)

- Decoration (1)

- Deeplearning (1)

- desire (1)

- Desktop (1)

- Digital content licensing (1)

- Disaster (3)

- Dojo (1)

- Drawbacks Of Artificial Intelligence (1)

- Duniyadari (5)

- Duniyadari #ChatGPT (1)

- Duniyadari blog (1)

- Dwarka (1)

- earn (2)

- Earn Money (4)

- Earth (1)

- Earthday (1)

- Earthquake (2)

- ECG (1)

- economic (1)

- EdU (1)

- Education (13)

- education chatbon chatbot in education (1)

- Education Rural Development Better Future (1)

- Education sector (1)

- Educational (1)

- educational chatbot (1)

- Elon Musk (2)

- emotional AI (1)

- Emotions (1)

- ENGLISH (3)

- enhance legal aid with ChatGPT (1)

- Enhancedvisualsearch (1)

- Environment (1)

- Environmental Impact (1)

- Essentials Artificial Intelligence Laws (1)

- Ethical AI Development (1)

- face recognition (1)

- Facebook (3)

- FAQ (1)

- Fashion (1)

- featuring (1)

- festival (1)

- Financial Technology (1)

- Fire (1)

- Fire In Forest (1)

- first ai (1)

- First AI in Iraq (1)

- First Artificial Intelligence I AI (1)

- First case of Corona (1)

- Folk (1)

- Food (1)

- Football (1)

- for nonprofits (1)

- forfuture growth engineopenai (1)

- Foundation (1)

- Free AI courses (1)

- Free chatbots for users (1)

- free earning tips (1)

- Free Prompts (1)

- freelance marketplace (1)

- freelancer experience (1)

- Frustration (1)

- Function (1)

- future (3)

- future AI (1)

- future chatbots (1)

- Future Search engine (1)

- game (1)

- Games (1)

- Garry Kasparov (1)

- Gemini (1)

- generative AI (4)

- Global (1)

- global warming (1)

- Goal (1)

- goodness (1)

- Google (9)

- Google Adsense (1)

- Google Bard (4)

- Google certificate (1)

- Google course free with certificate (1)

- Google Gemini (1)

- Google lense (1)

- Government (2)

- Government College for acting (1)

- gpt (4)

- GPT models (1)

- gpt prompts (1)

- GPT Store (1)

- GPT-3 (1)

- GPT-4o (1)

- GPT-4o Mini (1)

- GPT4 (1)

- Grammar (1)

- Greatest Awards (1)

- Greatest Player (1)

- Grimoire (1)

- Grocery (1)

- Grok (1)

- Grokai (1)

- growth engineopenai potential (1)

- guard (1)

- Gujarat (1)

- habits (1)

- happiness (2)

- happy birthday (1)

- Happy new Year (1)

- Hawai (1)

- Health (1)

- health and wellness (1)

- healthcare (3)

- Heartbeat (2)

- help students homework (1)

- Heritage (1)

- highly risky regulatory (1)

- History (2)

- how does OpenAI Make money (1)

- hugging face (1)

- Huggingface (1)

- Humen actvities (1)

- Ideas (1)

- Illya Sutskever (1)

- Image (2)

- images (1)

- images Editing (1)

- Immersity AI (1)

- Impact (1)

- inaugural (1)

- Indeed Invite to Apply feature (1)

- Indeed and AI integration (1)

- India (5)

- Indicator (1)

- industry leader (1)

- infant (1)

- information (1)

- instagram (2)

- intelligence (4)

- Intercom (1)

- international gaming company (1)

- Internationalexam (1)

- Internet (4)

- Internet computer (1)

- interview (1)

- Intraday Tips (1)

- Intrest (1)

- Investment (1)

- Investment Algorithmic Trading (1)

- Investors (1)

- iOS (1)

- Iphone (1)

- isro (1)

- It's Effect . (1)

- Japan (2)

- Job (3)

- Job In California (1)

- Job market trends (1)

- Job seeker experience (1)

- job updates (1)

- Jobs (3)

- journalism (1)

- Jr.NTR (1)

- Junagadh| Gujarat| India (1)

- keyword (1)

- kickstart (1)

- Kiribati 🇰🇮 (1)

- Kraftful Products Coach (1)

- kyutai (1)

- language (1)

- language model (2)

- Largest Temple in the world (1)

- learn prompts (1)

- Learn stock market (1)

- learn with AI (1)

- learning (1)

- learning precision medicine (1)

- life (3)

- Lightning AI (1)

- LitGPT (1)

- live images monolisa (1)

- LlaMa (1)

- LLM (9)

- LLMs (1)

- London (1)

- loopt y combinator openai (6)

- Low-cost AI applications (1)

- Luxury (1)

- machine (1)

- machine learning (6)

- Mails (1)

- make life easier (1)

- Malaysia (1)

- Man. (1)

- Maradona (1)

- market (1)

- Market Prediction (1)

- Marking Scheme (1)

- Mathematics (1)

- maths question (1)

- maximize benefits of AI technology (1)

- Medical (1)

- Medical Exam (1)

- Melaka Chess. (1)

- Memory (3)

- Merry Christmas (1)

- Meta (1)

- Meta AI WhatsApp (1)

- Meta chatbot (1)

- MetaAI (1)

- metaoneverse (1)

- Microsoft (10)

- Midjourney (1)

- minds (1)

- Mira (1)

- Mira Murati (1)

- Mobile (1)

- monalisa (1)

- money (5)

- money profit (1)

- Moshi AI (1)

- motivation (1)

- moves (1)

- Movie (1)

- Multimodal reasoning (1)

- Murati (1)

- Naatu-Naatu Song (1)

- Nacho-Nacho (1)

- nasal (1)

- National Research (1)

- National Youth Day (1)

- Nattu-Nattu (1)

- Natural Disaster (2)

- Natural disasters (1)

- natural language processing (2)

- Natural Language Processing (NLP) (1)

- Nature (2)

- NCERT (1)

- NEET (1)

- nevergiveup (1)

- New ads policy (1)

- new AI code (1)

- New model (1)

- News (17)

- NextGen (1)

- nlp (1)

- NSD (1)

- NTA (1)

- Occupied kasmir by India (1)

- Ocean (2)

- OECD (1)

- Office (1)

- online (1)

- Online Course (1)

- online education (1)

- online money using ChatGPT (1)

- OpenAI (64)

- OpenAI ChatGPT News USA Artificial (1)

- Openai Career (1)

- OpenAI fine-tuning (1)

- OpenAI partnership (1)

- openai sam altman (7)

- Openlayer (1)

- opinion words data-driven (1)

- Opportunity (1)

- Oscar Awards (1)

- Pakistan (1)

- Pakistan and China (1)

- Parajumble Questions (1)

- Personalized searchresults (1)

- phile (1)

- Photo (1)

- photo Editing (1)

- PM Modi (1)

- PM of India (1)

- Podcast (1)

- pollution (1)

- Popular Question USA (1)

- Positional Trading (1)

- positions (1)

- positive (1)

- post (1)

- Prince Action Trading (1)

- Prize (1)

- product development (1)

- product nfts (1)

- productivity (1)

- programming (2)

- prompt (1)

- prompt engineering (1)

- Prompt writing Tips (1)

- Prompts (4)

- Prompts engineering course (1)

- Promt writing Tips (1)

- Protection (1)

- PyTorch Lightning (1)

- Question Paper (1)

- quotes (1)

- Rajouri (1)

- Rakuten (1)

- Rakuten deal openai (1)

- Ramcharan (1)

- Real-timedataanalysis (1)

- receives equity stake (1)

- recent monetization openai (1)

- recognize patterns medical (1)

- Redcliff (1)

- reduce burden hr (1)

- research (2)

- Resignations (1)

- responsible gaming (1)

- richest (1)

- rocket (1)

- Rockset (1)

- RRR (1)

- safety (1)

- sam (4)

- sam altman (9)

- sam altman ai (6)

- sam altman ceo (1)

- sam altman investments (2)

- sam altman linkedin (6)

- sam altman open ai (6)

- sam altman openai (6)

- sam altman y combinator (6)

- Sam Fired (1)

- sapcex (2)

- Scalping (1)

- Scholarship (1)

- Schools (1)

- Science (1)

- Scope (3)

- ScopeofMaths #Mathematicalproblemsolving #Skills #process (2)

- search engine (3)

- search engine market (1)

- searchgpt (1)

- SearchGPT prototype (1)

- Season (1)

- Secured Jobs (1)

- Sengol Narendra Modi (1)

- SenseNova (1)

- SenseTime (1)

- seo (1)

- Series 5 (1)

- services (1)

- share market (1)

- shares price initially (1)

- Siri (1)

- snakes (1)

- Soccer (1)

- software (1)

- sorrow (1)

- space (1)

- Spoken practice (1)

- Sports (2)

- St. George (1)

- Stability AI (1)

- Stable Diffusion3 (1)

- startup (2)

- startups (1)

- Stethoscope (1)

- Stock Analysis (1)

- Stock Market (1)

- Stocks in English (1)

- Strawberry project (1)

- Sudarshan Setu (1)

- suffix (1)

- Superhit (1)

- Swing Trading (1)

- Synthesia AI (1)

- system Cards (1)

- Teacher (1)

- Teaching (2)

- tech (1)

- tech blogs (1)

- technological (1)

- Technology (38)

- Technology #Internet #computer (1)

- technology curve (1)

- Technology in 2024 (1)

- Technology mobile (1)

- Telugu (1)

- Tesla (2)

- Text and vision support (1)

- think big (1)

- Thom Browne (1)

- Tim cook (1)

- time (1)

- Titan Submarine (1)

- Titanic (1)

- top (1)

- top talent (1)

- Top University (1)

- Topper (1)

- toung twister (1)

- tourism (1)

- trading (2)

- Trading Strategies (1)

- Trails (3)

- travelling (2)

- travelling for all (1)

- trend opinion world (1)

- Trending (1)

- Trends (1)

- Turkey 🇹🇷 😢 (1)

- tutoring course creation (1)

- TwitterX (1)

- UAE (1)

- UNESCO (2)

- United State (1)

- Upwork (2)

- US (3)

- USA (7)

- USA Artificial (1)

- use ChatGPT (1)

- users (2)

- Vaccination (1)

- Valentine (1)

- variety (1)

- Varkey (1)

- venomous (1)

- Veteran (1)

- Vignette Ads (1)

- virtual assistant (1)

- virtual chat agent (1)

- Voicesearchoptimization (1)

- wall painting (1)

- wealth (3)

- wealth creation (1)

- weight loss (1)

- Whatsapp (1)

- WhatsApp telegram community (1)

- when (1)

- where why (1)

- which is better chatbots (1)

- wild (1)

- Wishes (1)

- Women in AI (1)

- work (1)

- Worlclassbrand (1)

- world (7)

- World artificial intelligence (1)

- World best Apps (1)

- World news (1)

- world predator (1)

- world's first (1)

- writing (2)

- Wuhan (1)

- X (1)

- Xtuner (1)

- Y (1)

- y combinator sam altman (6)

- Youth (1)

- Zico Kolter (1)

- माँ पिता परमेश्वर (1)

- शातिर अपराधी विकास दुबे (1)

https://www.facebook.com/profile.php?id=100080054237461

Recent Posts

Blog Archive

-

▼

2023

(119)

-

▼

June

(9)

- World's smallest LV Bag is Auctioned: Rice Sized B...

- Best and Fast Way to Learn About Stock Market To E...

- Best Way To Earn Money Online in 2023 Free

- Finding The Debris of Titanic Titan Submarine Impl...

- Cyclone Effects In India: Biparjoy In Gujarat

- NEET Result Out: Checking Your Result Direct Link

- Should You Participate in Math Olympiad :2023

- 4 worst Habits Of Unsuccessful people: Rich Vs Po...

- Top 16 Trending Keywords on Google 2023: Most Sea...

-

▼

June

(9)

Search This Blog

Search This Blog by Duniyadari AI blogs

AI Blog

Ad Home

Recent Posts

Duniyadari MishraUmesh07 Blog was Founded by Umesh Mishra more than 300 AI blogs you can read!

Variables / Comments

Get Gifts

Contact Form

Translate

Follow Us

https://instagram.com/insurancepostindia?igshid=ZGUzMzM3NWJiOQ==

About

Beyond the Technology We are writing about world ,India Heritage, nature and latest news

Duniyadari MishraUmesh07 Blog was Founded by Umesh Mishra more than 300 AI blogs you can read!

Blogroll

Comments

Most Recent

Future of Artificial Intelligence

August 28, 2024

How OpenAI Works

August 17, 2024

OpenAI’s acquisition of Rockset

August 05, 2024

Best and Fast Way to Learn About Stock Market To Earn Money

Mishraumesh07

June 26, 2023

Best and Fast Way to Learn About Stock Market in detail it consists of 3 parts:

1.What are the Types of Trading?

2.What are the Different Trading Instruments available to Trade?

3.10-Steps to Elevate your Trading Skills

Checklist before taking Trading as Full-time Career

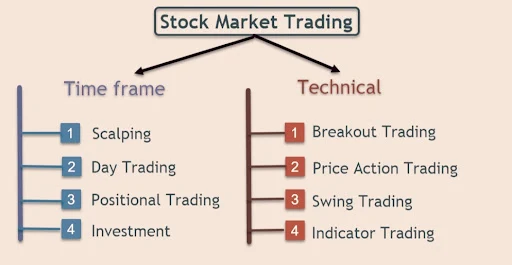

What are the Types of Trading?

Different types are trading in the stock market based on two parameters:

- Time-frame of the trade

- Technical Aspect

Based on the timeframe of the holding, we can identify 4 different forms of trading.

1 - Scalping

Scalping is a very short-term trading strategy that aims to make profits from the trades' quantity and volume rather than focus on maximizing each trade's gains.

Typically the holding period is very few minutes. It got its name because people who adopt the style—known as scalpers—they quickly enter and exit the market to accumulate small profits off of a large number of trades (and quantity) throughout the trading day.

Please note only experts can do successful scalping. If you are a beginner in the stock market, please avoid scalping.

2 - Day Trading

Day Trading, also recognized as Intraday Trading, is a famous trading type in the trading community.

In Intraday Trading, one has to close their trade on the same day. If the stock has moved in the expected direction, then the traders will make profits. Otherwise, they lose money.

Suppose a stock opens at Rs 200 in the morning, and soon price moves to 225 within 1-2 hours. If a trader had bought 1000 shares in the morning and sold at 225, then he would have made a decent profit of Rs 25,000 within a few hours. This is the advantage of Intraday Trading.

3 - Positional Trading

Positional trading is a type of trading in which a trader carries the positions overnight for a few days or weeks.

A person need not be a full-time trader and keep himself glued to the screen for the entire day like a scalper or intraday trader.

BTST trades, STBT trades, or any trading type with a few days to few weeks holding period will fall under positional trading.

4 - Investment

Any holding period between a few months to years will fall under the investment category.

When it comes to investing, there are two schools of thought:

Fundamental Analysis and

Technical Analysis

Fundamentalists are more concerned about the company's management, various products, Sales, Price to earnings ratio, Balance sheet, Cash flow, Debt to equity ratio, etc. Broadly they are concerned about qualitative as well as quantitative aspects of the Company analysis.

Technical Analysts consider the analysis of past behavior of prices to interpret their study. They believe that the price contains all the information, and it's enough to analyze the price chart.

Again based on the technical concepts, we can identify 4 different forms of trading.

1 - Breakout Trading

A breakout trade opportunity is nothing but a stock price moving outside a defined resistance level with increased volume.

A breakout trader enters a long position after the price breaks above the resistance level, keeping a stop-loss below the resistance.

In this process, they either trail their stop-losses or target to exit at higher levels to make profits.

2- Price Action Trading

'Price Action Trading' is a trading technique in which a trader reads the market and makes subjective trading decisions based on the price movements, rather than relying on technical indicators or other factors.

In simple words, traders use only 'Price' and 'Volume' to make any trading decisions.

3.Swing Trading

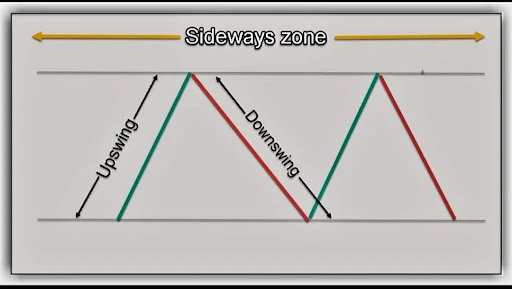

Swing trading is a trading technique that seeks to capture a swing when the price goes to a complete sideways zone.

The idea is to get out of the trade before the opposing pressure comes in. It means you look to book your profits before the market reverses.

1.Swing Trading Strategy

1. Identify a range-bound market or script based on individual choice.

2. Observe price action carefully at the Support level (for a long trade) and the Resistance level (for a short trade).

3. If there is a firm price rejection at the support level, then go long on the next candle open (the technique is the same for a short trade if there is a rejection at resistance level).

4. Trial your stop-loss when the price moves upside and book profits before the Resistance level (for short trades, book profits at support level).

4 - Indicator Trading

In this type of trading, traders depend on 1-2 indicators to plan their trades.

Technical Indicators help beginners in the stock market as they bring some discipline by avoiding unnecessary trades. They also help Algo Traders to design a mechanical system to manage their work.

I will take one simple example of the ‘Stochastics’ indicator.

Stochastics is an oscillator that compares the closing price to the range of its prices over a given period in the selected instrument. Then it plots the values within the range of 0-100.

A reading of 80 and above is considered overbought, and a reading of 20 and below indicates oversold.

What are the Different Trading Instruments available to Trade?

We have below 3 trading instruments in the stock market:

1. Equity

2. Futures

3. Options

So, a trader should know how these trading instruments work.

Let us take an example to understand better.

Assume one Trading Account has Rs. 3,50,000 (3.5Lakh).

ACC Current Market Price CMP is 1630

Assume ACC went 5% (81 points) up in the next 2 trading days. (Explanation sake)

Case-1: Equity

With 3.50 lakh, one can buy 205 shares.

Profit made due to 5% upside movement is Rs.16,605(205 shares X 81 points)

ROI on Capital is 5%

Case-2: Futures

With 3.50 lakh, a trader can buy 1 lot (400 shares).

Profit made due to 5% upside movement is Rs. 32,400 (400 QTY X 81)

ROI on capital is 12%

Case-3: Options

With 3.50 lakh, one can buy 7400 QTY of 1800 CE of ACC.

jump to Full-time trading to avoid the problems in their current profession.

Below are the checklists one should look at before they consider Intraday Trading as a full-time career:

1) Zero Debts: If a person has a monthly commitment (EMI) towards any loan, this will add extra pressure to his Trading career as he has to generate this commitment amount every month. Sometimes, there will be no opportunities in the market. If he fails to make money in the market, extra pressure will be created in his mind, impacting his trading decisions.

2) Savings: One should save enough money to run the family for at least one year. Suppose if a person needs Rs. 1, 00,000 (or 2000 USD approx) per month to look after all the expenses in your family, he has to save Rs. 12, 00,000 (or 24,000 USD approx) before taking trading as a full-time business. This amount is excluded from the trading capital.

3) Trading Results: Trading looks very simple when a beginner makes some quick money. However, one should realize that the market conditions are always dynamic. It requires enormous skills to make consistent money in the market. So it is better to measure our trading success before we take the extreme step.

It is a good idea to consider yourself as a successful trader only when: (I) you make at least six months of your current salary from trading profits in total and (II) you make profits for three consecutive months in trading.

4) Trading Capital: Only the above parameters are insufficient to quit the current job and jump into trading. One should have sufficient Trading capital to make profits in the market. Suppose a trader can make 10% returns every month, then he needs a minimum of Rs. 10, 00,000 (or 20,000 USD approx) as your trading capital if your monthly expense is around Rs. 1, 00,000 (or 2000 USD approx).

5) Trading Discipline: One of the most significant features in full-time trading is ‘You are the Boss’ to your work, and you do not have to report it to anybody. Usually, we are used to the ‘Reporting’ style of work, and this freedom may work against you if you do not have serious trading plans and goals. Hence, it is better to have some goals before a person commits to full-time trading.

For existing traders and investors it has few post about the technical analysis also, which can be visualized on their YouTube channel even.

Still You have Confusion We Will Give you some Questions that your Find in Youtube Directly And cam Gain Knowledge From Basics.

1.Beginners Guide: How to Start investing in Stock Market (NSE/BSE/MCX)

2.How to Start Trading In Commodities, MCX?

3.What is Demat Account and how to use Terminal for trading

4.What Are Stock Options?

5.IPO: INITIAL PUBLIC OFFERING IN INDIA

Points to Consider before investing

Introduction to Mutual Funds in India

Articles for Traders and Investors:

1.30 Movies based on WallStreet and Stock Market

2.10 Do's & Don'ts For Traders & Investors

3.LIST OF WEBSITES FOR LIVE MARKET RATES

3.Investment Options for Short Term and Fix Income In India

4.How can you make 2000-5000/- daily in stock market yourself?

Articles on Technial Research:

1.What are Candlesticks Patterns chart?

2.Learning Bullish Candlestick Patterns:

3.Learning Bearish Candlestick Patterns

4.Learning: How To Use Support Resistance For Trading

We Will Discuss in Next Articles

Disclaimer

Remember To Earn money is not Very easy in trading you may loose your capital so Before Going to Enter in The Market please Research and Learn About Psychology of Market , Trade your own Risk We are not responsible for any kind Of Loss.

Popular Posts

First AI Robot In The World: Sophia Human Robot

October 21, 2023

Microsoft’s VASA-1: Bringing Images to Life with AI

April 24, 2024

AI Experiment With Chat GPT-4 OpenAI latest news

October 20, 2023